Who Are You? How Bank Apps Confirm Your Identity Without Meeting You In Person

Did you ever try to find out how banks and online applications discover that the one who is logging is you?

Well, there are a lot of ways that online banks and mobile apps have implemented utilizing strong security algorithms to ensure that you are only accessing your account and protecting your financial and personal information.

How Do Banking Apps Identify Who You Are?

Contents

In this article, we will discuss the top few strategies that banks have implemented to ensure that the one who is accessing the account is you only(the owner of the account).

Top Security Features Implemented By Banking Applications To Identify Users

The top security features implemented by banking applications to identify the users are as follows.

🔖 User Identification

The initial step that the bank needs to follow is to identify the user. During the user identification, they check if the person who is accessing the account is the owner of the account.

A few of the common ways to make user identification are username and password, however, these are quite vulnerable and less secure methods that can lead to phishing and hacking attacks. As an outcome, now most of the banks have implemented 2FA(2 Factor Authentication).

By enabling the two-factor authentication, you can prove the ownership of your account twice before you get access to your account. The first step is to enter your login details like a password or the PIN and the second step is to use some token that is only available on your device. This additionally protects your account by adding an extra layer of security, making it quite difficult for cybercriminals to gain access to your bank account.

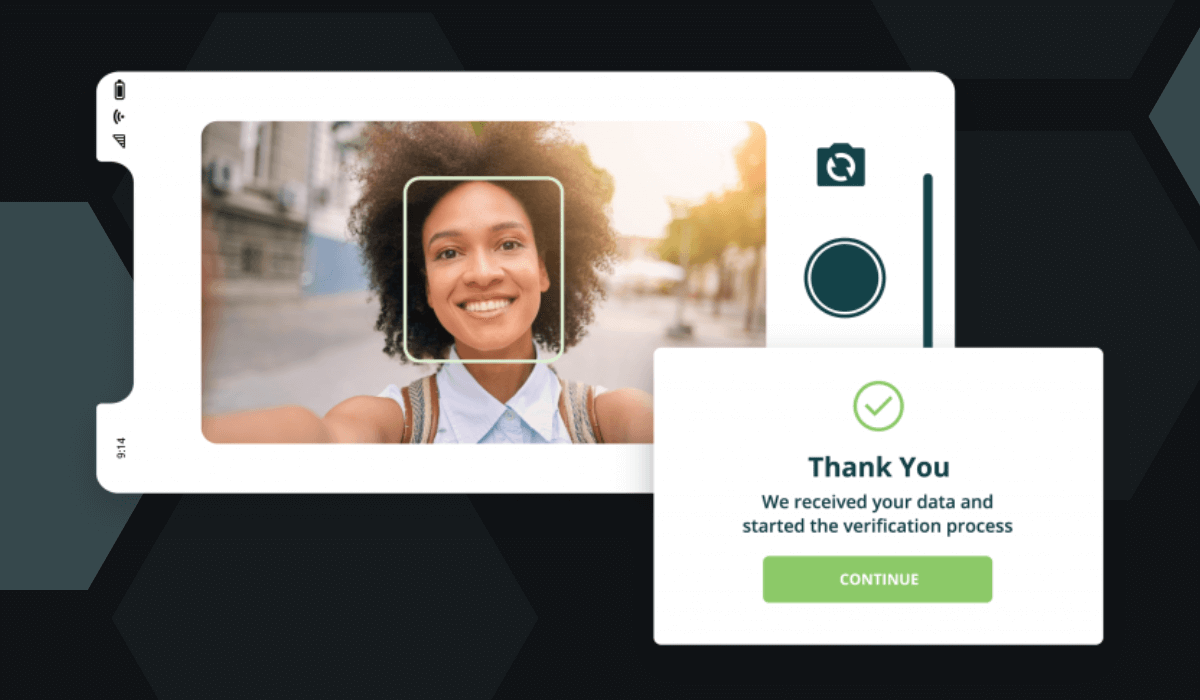

🔖 Biometric Authentication

Another advanced security measure that banks have taken is Biometric authentication. With the help of this, you can authenticate your account with either your fingerprint or your face.

In the last few years, biometric authentication has become quite popular as it has added a lot of security and convenience to the user’s activity.

One of the common forms of biometrics is fingerprint. Users need to scan their fingerprints to log in to the account. If it doesn’t match then you can’t open your account.

Another way is face recognition, where you scan your face to get access to your account.

🔖 Risk-Based Authentication

Another way of authenticating users while login is through risk-based authentication. Risk-based authentication is completely based on behavioral biometrics and machine learning algorithms to analyze and determine risk levels based on user behavior.

Some of the key metrics that play an important role to analyze user behavior are identity checks, mouse movements, typing speed, and several other patterns. Companies widely use it to avoid or detect fraudulent activity.

Secondly, Geolocation is another type of risk-based authentication. Users are only allowed to open their accounts from the location. If someone tries to open an account from a new location then it may trigger some security measures like biometric authentication or two-factor authentication.

🔖 Device Identification

Along with user identification, now most of the bans are also implementing device identification to know that the account from which it is accessed is the trusted device.

The defined authentication is usually done by device profiling, device fingerprinting, and device recognition. Device recognition also helps to know which device is being used to access the account.

Further, to authenticate the device, there are different methods used such as sending the one-time code to the user’s email or phone number. Moreover one can also use the security key to authenticate their device.

🔖 Data Encryption

Data Encryption is commonly used in the banking and healthcare sector. In the banking industry, Data encryption algorithms are used to encrypt the banking data such as financial and personal data, and protect it from hackers.

A few of the commonly used data encryption algorithms are SSL/TLS encryption. With the help of these encryption algorithms, the data is encrypted end to end while it is being transmitted.

🔖 Fraud Detection

With the help of fraud detection, banks implement another level of security. For it, they utilize real-time monitoring and machine learning algorithms to detect any uncertain activity in the user account.

The real monitoring catches any unusual activity such as large transfers or purchases to the new account. Whereas with the help of a machine learning algorithm, one can detect the patterns that can be used to discover any anomalies in user behavior and report them to the bank.

Talking about real-time monitoring, there is also a tool used called transaction monitoring that aims to detect any potential fraud. Using this tool, all the user’s transaction history is analyzed and then tried to match with the fraud patterns.

If in case a bank discovers some suspicious transaction, it might ask you to freeze your account or verify the transaction.

🔖 Privacy Concerns

Even though a lot of banks and financial institutions are doing their best to implement the highest level of security, still with a lot of apps, privacy concerns are there. One such concern is the use of users’ personal information.

When any user signs up for a bank account, they are required to submit a lot of details like their social security number, phone number, address, and name. This information is further used to identify the user’s identity and authenticate it, but it also opens up privacy concerns among the users.

Furthermore, you might have seen a lot of banks partnering with third-party providers to offer additional services.

For example, most of the providers might be offering an investment advance or budgeting tool that requires access to your personal information. This usually raises a lot of privacy concerns among the users.

🔖 Compliance With Privacy Regulations

A lot of banks have now partnered with the firms to help them tackle privacy concerns. In countries like the USA, there are two major privacy regulations known as Gramm Leach Bliley Act(GLBA) and California Consumer Privacy Act(CCPA) which all the banks need to comply with.

The CCPA requires all the customers to know what all their personal information is collected and gives them a choice to opt from the use of their personal information for any use case.

Whereas, the GLBA requires banks to offer a privacy notice to their customers that should contain complete information about what all information is collected and how it is used and shared.

Use Of Emerging Technologies In Banking To Protect Users From Any Hacks

- Technology is advancing at a rapid pace, daily new features are implemented in various industries including banking. By leveraging such advanced technologies the banking sector can enhance the overall user experience of the customers and their security of them. A few of the commonly used technologies are quantum cryptography, blockchain, and biometrics.

- In recent times, behavioral biometrics has gained popularity which utilizes advanced machine learning algorithms to analyze user behavior. With the help of this, banks are now able to authenticate and identify customers. A lot of banks have now adopted this technology to offer a new level of security to users.

- Secondly, Blockchain technology is being used to store data in a decentralized manner and tamper-resistant record-keeping ledgers. By leveraging blockchains, banks can store data in an encrypted form that can not be tampered with or modified by any hacker. This technology also enables faster transaction processing.

- Quantum Computing or Quantum Cryptography is a hot technology these days, as it leverages the principles of quantum mechanics to transfer data and communicate it between two different parties. Quantum computing Cryptography algorithms are quite strong and it is quite difficult to crack the encryption.

- Along with the technology, there are also a few other areas where advancements have led to improvisation in online banking. For example, voice recognition is now widely used in the banking sector to authenticate the user. For nontech-savvy people, it can be quite a great option who find it difficult to use other authentication methods.

- Furthermore, there is also gesture-based authentication is also being used by banks to authenticate users through their gestures. This technology gives an extra layer of security to the users and helps them to authenticate themselves using gestures.

- Last but not least, you will also see a lot of constant improvements being made to user authentication and fraud detection. With the help of advanced technologies like Artificial Intelligence and machine learning banks are now able to prevent and detect any fraudulent activity.

Takeaway

In conclusion, a lot of users are now using banking applications and making them an integral part of their day to lives. Some of the benefits they offer are easy access tot he financial information and convenience to the user, however, there are also some concerns related to user authentication and security.

To address those concerns a lot of Banking firms and online banking application leverages technology for authenticating users. A few of them are biometric authentication, data encryption, fraud detection, and risk-based detection. However, it also needs to comply with regulatory firms to ensure that user data is always protected.

In the future years, we can see a lot of improvements happening in the banking industry to ensure that user and their financial information is safe with the banks.